ES Weekly View (Jan 21-24)

- st360llc

- Jan 20

- 2 min read

Yearly Analysis:

The market maintains its bullish stance, with ES prices consistently trading above the 2024 Value High after it revisited 2024 Value High at 5808-5815 zone.

The One Time Frame Up (OTFU) pattern continues to dominate, signaling sustained upward momentum.

Monthly Analysis:

The ES market has maintained a balanced state for the past four months.

Initially, the January 2025 profile also indicated equilibrium. However, buyers successfully propelled ES beyond January’s Value High after revisiting the lower distribution from November 2024.

This rebound marked a turning point, as ES quickly gained upward momentum, driving the market to hit January 2025’s High. Our focus now shifts to the next target: 6133.

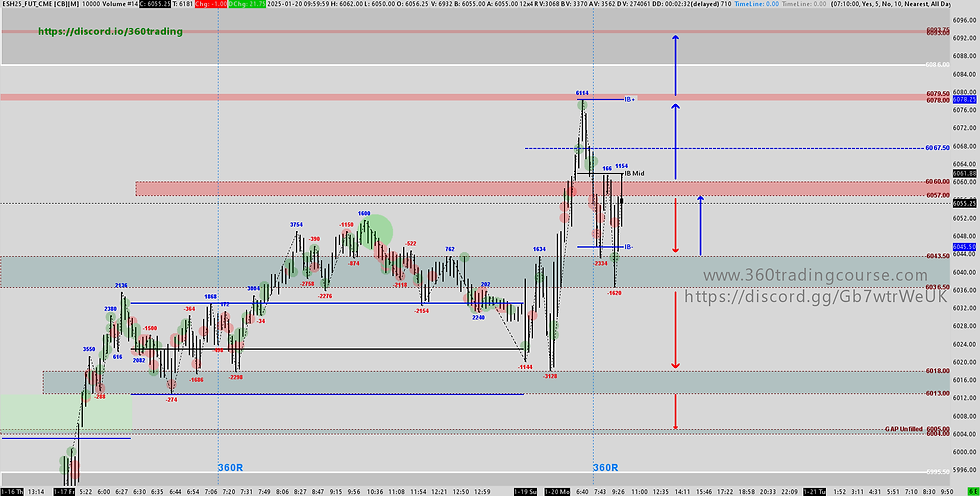

Weekly Analysis:

The Market Profile from last week painted a bullish picture for ES, showcasing an uptrend with a double distribution—an indicator of sustained positive momentum heading into this week.

To keep the bullish narrative intact, buyers must hold the critical support zone between 6000 and 6018 while pressing to breach the upper boundary of the three-week balance.

Our eyes remain firmly set on the next target for ES: 6133.

Daily Analysis:

Last week brought a compelling narrative for ES, marked by resilience in the face of bearish sentiment. Concerns of a market crash, fueled by the emergence of a head-and-shoulders pattern and five consecutive days of one-time-frame down (OTFD) activity, were temporarily eased as the market entered a three-day balance early in the week.

Wednesday Jan 15, 2025 saw a decisive directional move that left an unfilled gap between 5910 and 5951. By Thursday, the market settled into a two-day balance, only to reignite its upward momentum on Friday. This rally resulted in another unfilled gap (6005-6013) after several failed attempts to close it. The inability to fill these gaps would underscore market strength.

Monday, January 20, 2025, marked a momentous day as Martin Luther King Jr. Day aligned with the Presidential Inauguration, underscoring its significance in January's trading calendar. At the market’s opening bell, buyers attempted to break ES out of a three-week balance and push it into the higher distribution area outlined in the December 12 weekly profile. Their efforts were thwarted by sellers, who decisively regained control and dragged ES back into its established balance range, setting the stage for a fierce tug-of-war between market participants.

The 6036-6043 range emerges as a pivotal technical zone, reflecting a confluence of multiple days’ TPOs, Value Area High (VAH), Value Area Low (VAL), and Single Print levels. A sustained move above 6043 would pave the way toward 6057-6060, with a firm acceptance beyond this threshold unlocking potential upside to 6080. Should buying momentum remain strong, the market could extend gains to 6086 and eventually 6093.

Conversely, a failure to hold above 6036 would shift the focus to the gap at 6005-6013, making it a key target for sellers. If selling pressure intensifies, last week’s Point of Control (POC) at 5987-5989 will serve as a critical benchmark, providing essential clues about the potential for deeper downside moves.

ES 1/21/25 Key Levels (Please adjust the level after ETH session to have better accuracy)

Comments