Vistra (Ticker: VST) in Utilities Sector -Trade Idea for Swing/Long Term Trade

- st360llc

- Jan 12, 2025

- 2 min read

UTILITIES SECTOR

Company: Vistra (VST)

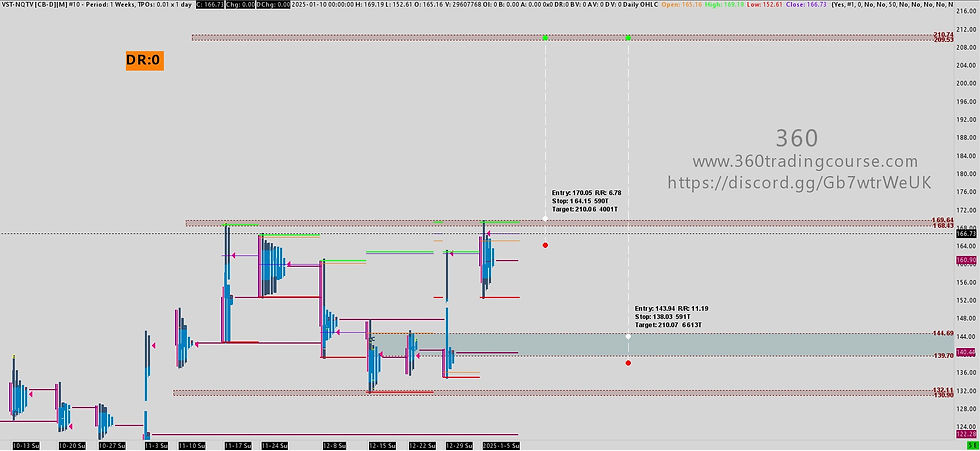

Price Target: $210

Vistra Energy stands as one of the foremost power producers and retail energy providers in the United States. With its landmark acquisition of Energy Harbor in 2024, Vistra now commands an impressive 41-gigawatt portfolio spanning nuclear, coal, natural gas, and solar power generation. Moreover, the company boasts ownership of one of the most significant utility-scale battery projects globally, reinforcing its position at the forefront of energy innovation.

Vistra Energy reported strong third-quarter results, accompanied by upward revisions to its guidance for 2024 and 2025, and signaled potential upside for 2026 targets.

The company’s nuclear contracting efforts, particularly with data centers, are progressing smoothly, with the Comanche Peak plant in Texas seeing robust demand.

Vistra also revealed a greater-than-expected volume of contracting opportunities spanning nuclear and gas assets, across PJM and ERCOT markets, and involving both established facilities and new developments. Investors can anticipate several catalysts driving momentum before the close of the year.

Technical Analysis

Vistra Energy’s technical outlook is deteriorating, with overall momentum decelerating and a heightened risk of further declines if key support levels fail to hold.

Despite outperforming the S&P 500 over the last 50 trading days, a close below the $144.01 threshold would signal a definitive trend reversal. While upside momentum, reflected by the 9-day RSI, remains in positive territory, it is beginning to lose steam.

Additionally, the stock appears overbought, as evidenced by a Slow %K stochastic reading exceeding 80.

On the positive side, trading volume over the past 50 sessions shows accumulation, with higher activity on up days compared to down days. The stock continues to trade above its rising 50-day moving average, a critical support level. Should this level give way, heightened selling pressure could ensue, with secondary support potentially emerging at the rising 200-day moving average.

Break out ATH is on scenario. If it does, wait for pull back and with high buy volume, you can add position

Wait for pull back to buy at the 2nd location, then you can add your position. See Chart Below

Comments